The Future of

Insurance AI

Transform insurance operations with our comprehensive AI-powered platform. "Lightning-fast processing, intelligent automation, unprecedented accuracy"

Nativeorange is at ITC Vegas, on October 14–16, 2025.

Why Insurance Needs Nativeorange?

Nativeorange streamlines submissions, accelerates decision-making, and enhances accuracy, empowering underwriters to focus on high-value tasks and drive better outcomes.

Traditional Underwriting

An overwhelming number of insurance submissions and limited ability to effectively prioritize.

No visibility into how underwriters' individual efforts impact the portfolio as a whole.

No way to track real-time changes in underwriting appetite or goal progress.

Dozens of disconnected systems and fragmented workflows across legacy technology.

The Nativeorange Approach

Submissions are automatically triaged by appetite, goals, and winnability, and the best deals are surfaced to underwriters first.

Each submission is presented to underwriters with up-to-date information on how it fits current appetite, guidelines, and portfolio.

Teams get real-time, easily-accessible reporting on the state of the portfolio, allowing for effective analysis and course correction.

The entire underwriting workflow is consolidated into a single pane of glass for greater efficiency and visibility.

Nativeorange

Products

Comprehensive AI-powered solutions designed to transform your insurance operations with cutting-edge technology.

Underwriting Bench

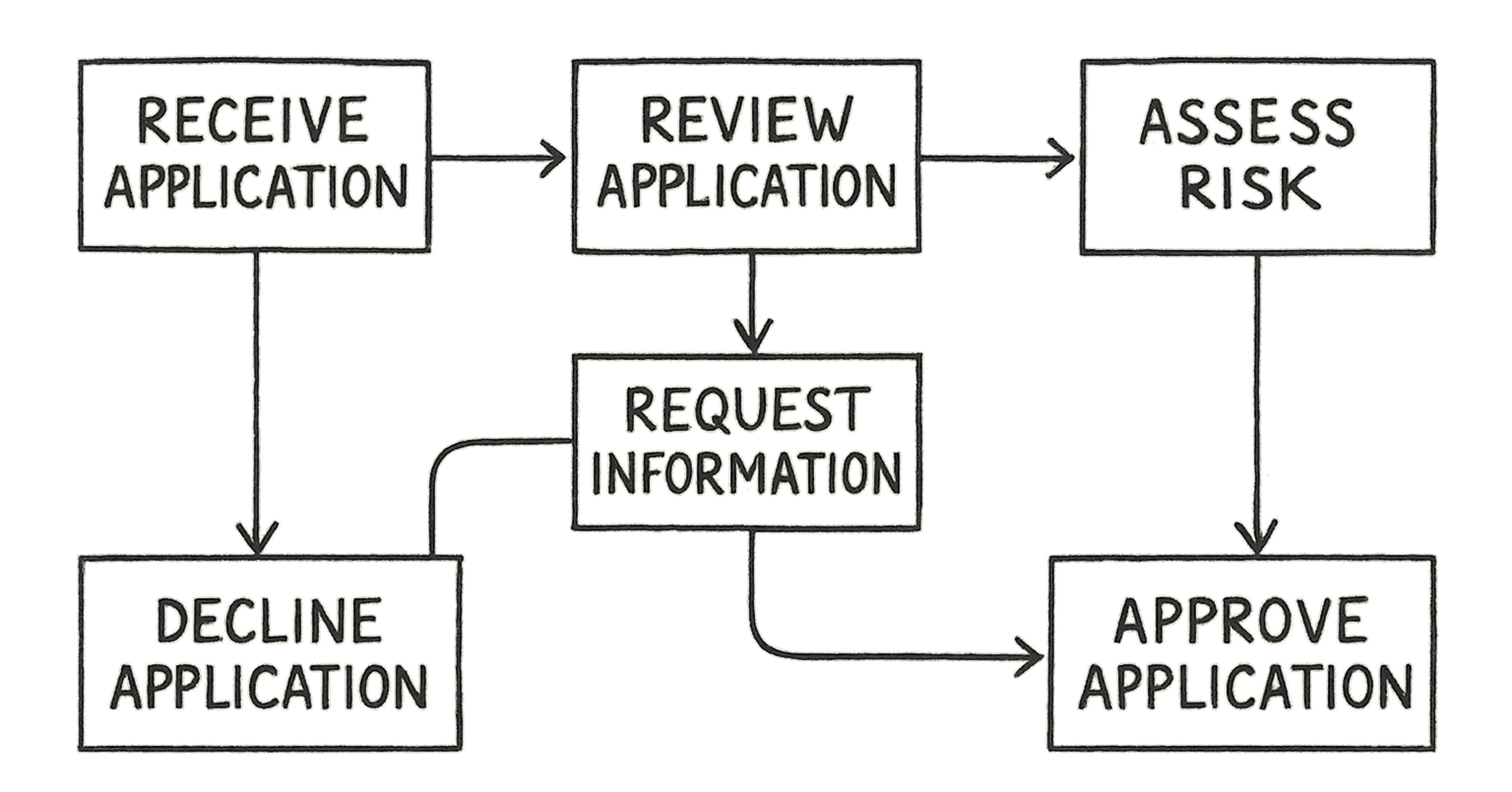

Underwriting bench is an agentic AI workflow that automates intake, submission prioritization, classification, risk analysis, appetite correlation, and rapid decision-making. It streamlines every step from initial submission to final decision.

Agency Bench

Agency bench is an agentic AI workflow that bridges insurance customers on one end and carrier selection on the other. It captures appetite at the source, eliminating the need for multiple forms and formats, and reducing manual effort by 90%.

Underwriting Studio

Underwriting studio brings our most powerful AI agents together to Strategize, Ideate, and execute underwriting workflows for insurance companies.

AI Agents

Our AI Agents can conduct specialized tasks well and integrate with your current Agentic and Legacy workflows. All our agents are state-of-the-art, supporting AG-UI, ADK, and MCP.

Orbit

One-click partner integration platform that enables trusted insurance data APIs to seamlessly connect with carriers and agencies using Nativeorange products. This unified integration hub eliminates traditional IT barriers, enabling real-time data flows that power smarter underwriting decisions and accelerate business growth across the insurance value chain.

Core Products

Deep Dive

Explore our flagship, innovative AI-powered platforms with detailed features, benefits, and performance metrics.

Underwriting Bench

Underwriting bench is an agentic AI workflow that automates intake, submission prioritization, classification, risk analysis, appetite correlation, and rapid decision-making.

Key Features

Intelligent Intake Processing

Automatically processes and categorizes submissions with 98% accuracy.

Risk Analysis Engine

Advanced AI models analyze risk patterns and provide instant recommendations.

Appetite Correlation

Matches submissions to carrier appetites for optimal, efficient placement.

Rapid Decision Making

Reduces decision time from days to minutes with advanced AI-powered insights.

Underwriting Studio

Transform complex underwriting challenges into intelligent, data-driven decisions with our comprehensive AI platform.

Idea to Execution — From Thought to Action

Agentic Analytics delivers real-time, autonomous insights for insurance underwriting. Advanced AI continuously analyzes market trends, customer behaviors, claims data, and emerging risks—automatically surfacing actionable intelligence. This agentic approach enables underwriters to make faster, more confident decisions, uncover hidden risk factors, and optimize strategies with minimal manual intervention.

Agentic & Autonomous Analysis — Always Watching, Always Thinking

The Underwriting Studio is continuously monitoring your business landscape. If submission volume drops in a region like Texas, it proactively investigates, identifies root causes, and even suggests strategies to correct course. It’s your autonomous underwriting analyst—always alert, always optimizing, ensuring you stay ahead of every market shift and opportunity.

Dynamic Workflow Creation — Build & Evolve on Demand

Need to adapt fast? Just tell the Studio. It can instantly create or modify underwriting workflows—adding API checks, automating CRM updates, or plugging new flows into your existing Underwriting Bench. No code, no waiting. Simply describe what you want, and the Studio builds it in minutes. It’s agility and precision, powered by natural language.

Why Choose Underwriting Studio?

Built specifically for insurance underwriting with deep industry knowledge, compliance requirements, and proven results across enterprise deployments.

Bring Ideas to Life

Transform underwriting concepts into intelligent workflows-instantly.

Rapid, Confident Decisions

Access data, insights, and recommendations in seconds.

Execute with Ease

From underwriter performance to campaigns, accelerate every step.

95% Less Effort, 10x Faster

Cut cycle times from months to minutes with Agentic AI precision.

AI Agent

Ecosystem

Each agent is specifically designed to excel in their domain, powered by your unique customer data for unprecedented performance and insights.

Nativeorange Agents. Everywhere You Work.